Future of Prescott Public Safety Depends on Passage of Prop 478

By the AZFPI Board

The funny thing about Prescott’s Public Safety ballot initiative (Proposition 478) is that no one, and we mean no one, disputes additional funding is needed for police and fire/emergency medical services (hereinafter, public safety). Not even talk radio show hosts, or the anonymous “coalition of small business owners” known as “No on 478” questions the need for more public safety funding.

No one is arguing our public safety response times haven’t seriously increased. No one is arguing police and fire buildings constructed in the early to mid-nineties aren’t sorely in need of rehab and/or expansion. No one is saying we don’t need more fire stations, a police substation, or police evidence storage. And no one has said we don’t need more police officers and firefighter/EMS personnel.

We all pretty much agree our public safety system is headed for life support ⎯ if not already there. And yet there is still opposition to a sales tax increase to fund something we all agree is needed. Why is that?

For starters, it is important to understand municipalities like Prescott collect the lion’s share of revenue primarily through a transaction privilege tax (sales tax). It is also important to understand that Prescott’s property tax raises very nominal revenue because it is capped at the state’s 2% legal limit.1

Secondly, Prescott city councils and voters have always been reluctant to raise taxes or fees ⎯ for any reason. This “No new taxes ⎯ ever” mantra created an inability to keep up with public safety expenses due to growth, events out of our control, and legal mandates. These include: 1) dramatic cuts in spending during the 2008 recession; 2) a historical failure to charge necessary impact fees to cover the full cost of public safety improvements for growth dating back to the 1980s; 3) and state law limiting the amount of property taxes cities can collect.

So today, while we agree we have a problem we can no longer avoid ⎯ we disagree on how to pay for it, or so it seems.

So today, while we agree we have a problem we can no longer avoid ⎯ we disagree on how to pay for it, or so it seems.

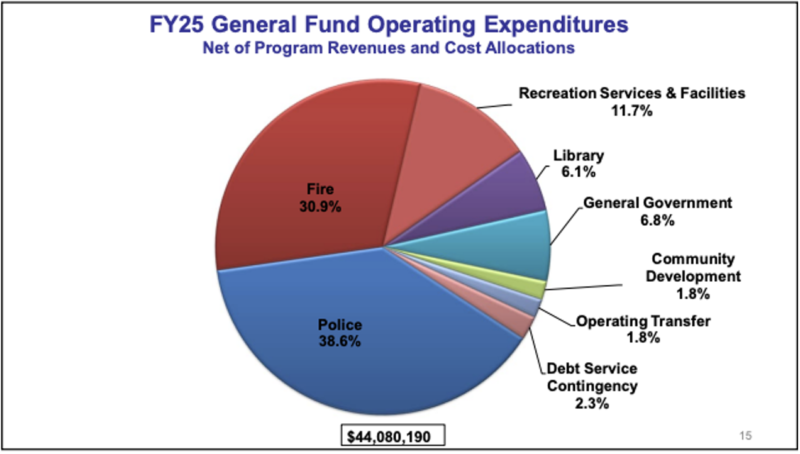

Some suggest the city simply needs to cut elsewhere. The question is where. Public Safety takes the majority of taxes needed to provide general government services.1 In addition to police and fire, general government services include things like parks and recreation, community development, library, legal and general administration. These non-public safety services make up roughly 30% of general government expenditures in any given budget year. The city can’t responsibly cut enough from these non-public safety services to pay for our deferred public safety needs.

Some suggest that because sales tax is a regressive tax impacting those least able to pay, this is a reason to vote no. But consider this: Prescott has a robust tourist economy. Using sales tax to fund police and fire expenses means visitors pay a portion of the costs. And, since the city is already collecting property taxes at the state’s legal 2% legal limit, property taxes are not an option either.

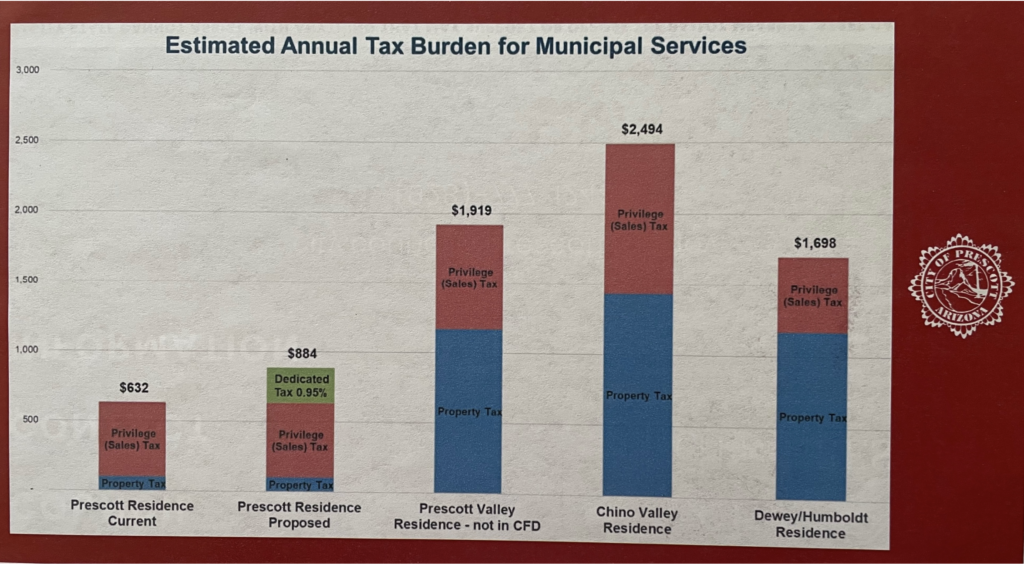

A critical point about property taxes to note here: Outside Prescott city limits, Central Arizona Fire and Medical Authority/Association (CAFMA) charges a separate, dedicated property tax for its fire/emergency medical services. The city of Prescott does not have the ability to do this. (And this article cannot emphasize enough, Prescott fire/emergency medical services are paid predominantly through Prescott sales tax revenues.) The chart below shows the estimated total tax liability for a $400,000 home, comparing Prescott to other cities in the region. All EXCEPT Prescott pay for fire protection from CAFMA using property taxes.1 Even with the proposed 478 public safety sales tax increase, Prescott continues to have the lowest total taxes in the region.

Others argue the city just needs to charge higher impact fees to pay for public safety. The problem is impact fees cannot be used for operating costs like police and fire personnel. Impact fees can only be charged to recover construction costs to serve future growth. The good news is on October 8, the current city council will consider adopting new impact fees which (as proposed) finally include full police and fire costs to serve future growth going forward.

Finally, some suggest “vote no” because there is a lack of trust the city will do the right thing with Prop 478 funds. Prescott is not unique in this regard. Trust in all levels of government is at historic lows. Recognizing this, the city committed to transparently manage Prop 478 funds in a dedicated revenue account inside the general fund as well as publicly report all collections and expenditures.3

Still not comfortable? Then this becomes a matter of weighing risks. We know for certain Prescott’s growth in population, square miles, and median age has resulted in more call volume and longer response times. Fire Department medical call response times now average 11 minutes ⎯ unacceptably higher than the 6-minute goal. Does one prioritize a mistrust in government and vote no on 478? Or does one prioritize that you or a loved one will survive a life-threatening health event or accident and vote yes on 478? Sounds dramatic, but voters always have recourse if our trust in the city is misplaced or abused. One of these choices we can recover from; the other one, maybe not.

NOTES

1City of Prescott, Budget and Finance Department, Budget Workshop, May 9, 2024.

2City of Prescott, Budget and Finance Department, 2024.

3 This account will be active and can be monitored by the public in early 2025 on Opengov.com.